With a view to garner additional revenue of Rs 6,000 crore, the West Bengal government has stressed more on tax compliance and simplification of the tax regime. It has also increased tax on foreign liquor and tobacco products other than bidis.

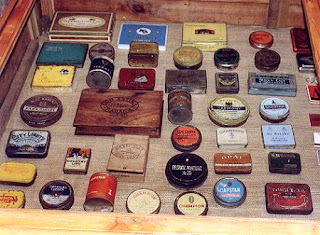

Presenting the Finance Bill in the Assembly on Monday, Finance Minister Amit Mitra put tobacco products such as cigarettes, gutkha and pan masala under schedule D of VAT, which enables the government to charge taxes more than the present 13.5 per cent.

“This has been done to empower the government to impose taxes on these products, which can cause deadly diseases like cancer. We will announce the quantum of increase soon. However, we have kept bidis, which is consumed by the common people, outside schedule D,’’ Mitra later told the media outside the House.

Mitra also raised tax on India-made foreign liquor by bringing it under schedule D. For alcohol sold at MRP (maximum retail price), VAT has been increased from 23 per cent to 27 per cent. Alcohol sold without MRP will attract a VAT of 50 per cent against the current 37 per cent.

No comments:

Post a Comment